So how does the spring budget affect YOU? We spoke to eight typical families who reveal how much they will 'save' | The Sun

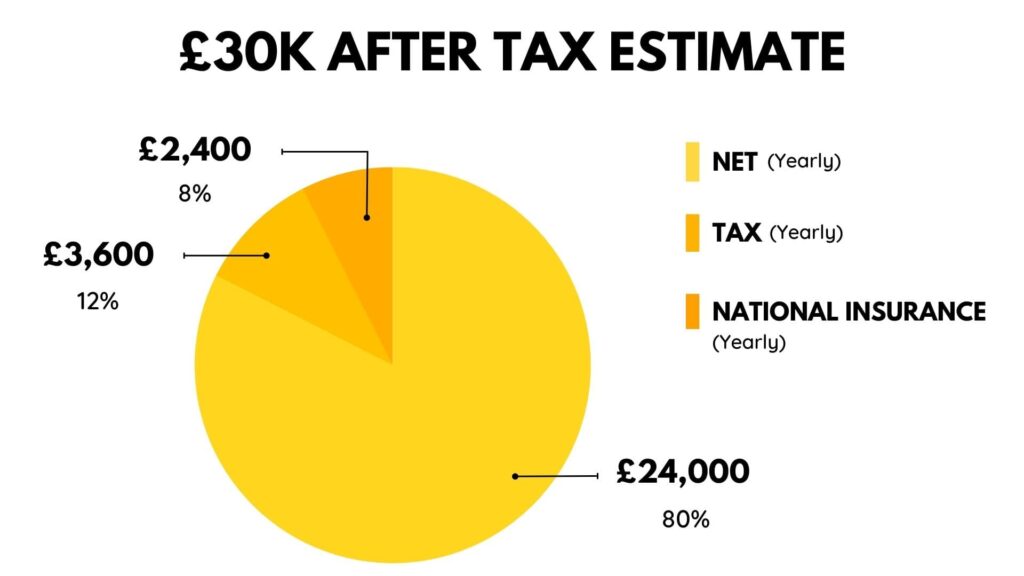

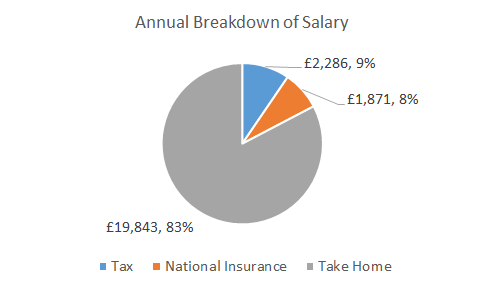

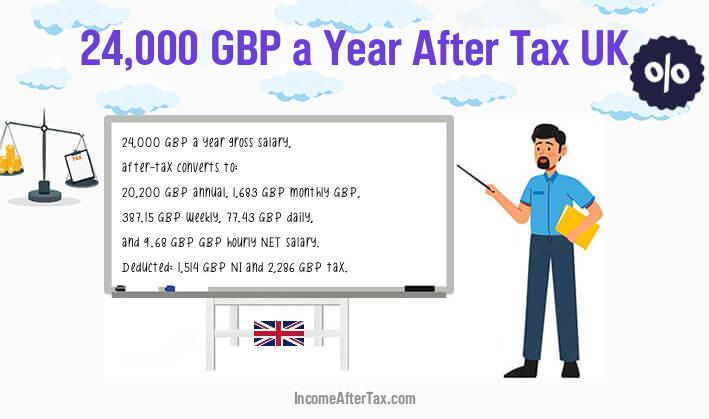

My Coatbridge on Twitter: "If you're a working Coatbridge resident living alone and earning a salary of less than £24,000* a year, you may be eligible for a fuel hardship payment of £