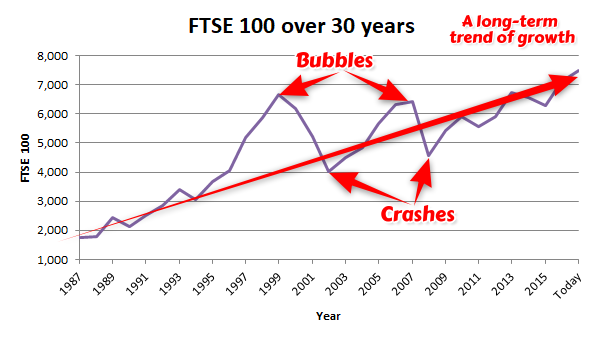

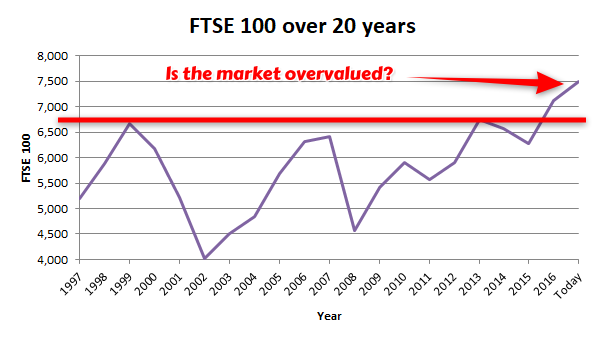

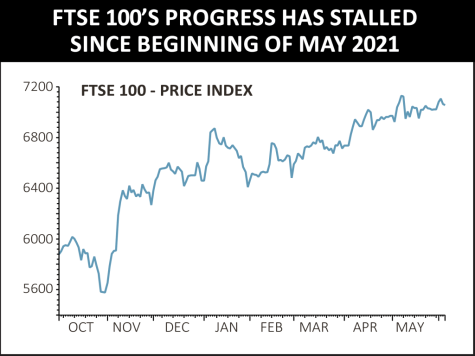

Market health check: Why have global stocks stalled and should you worry about inflation | Shares Magazine

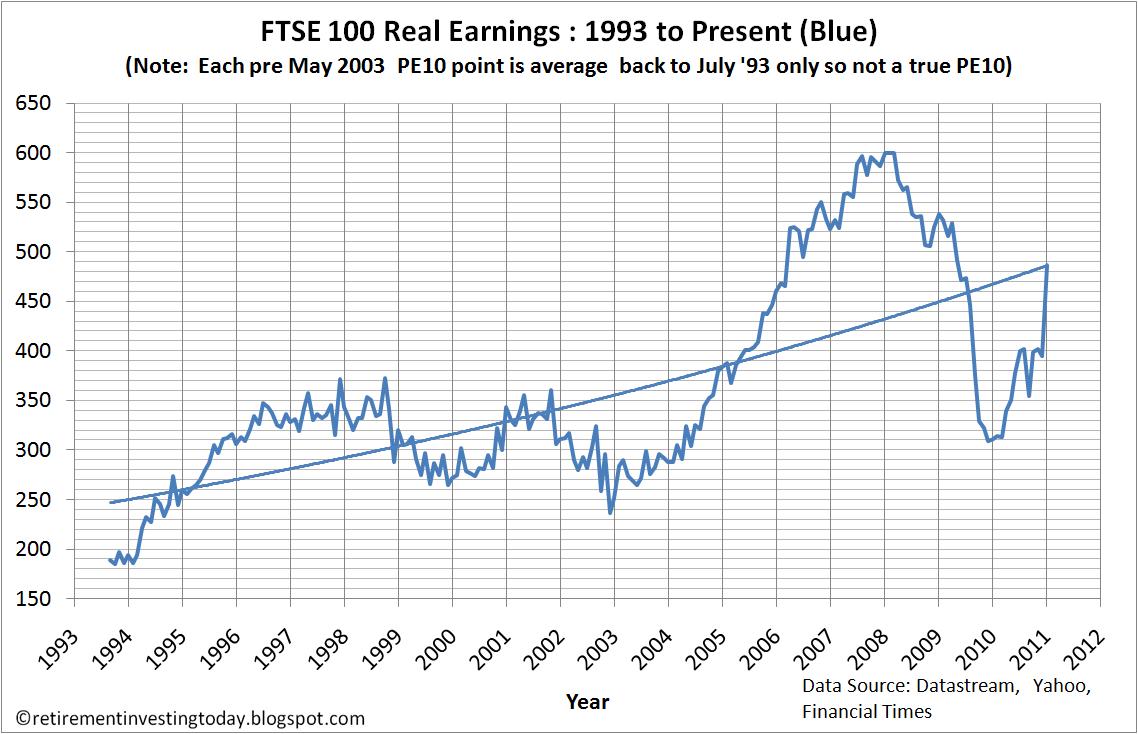

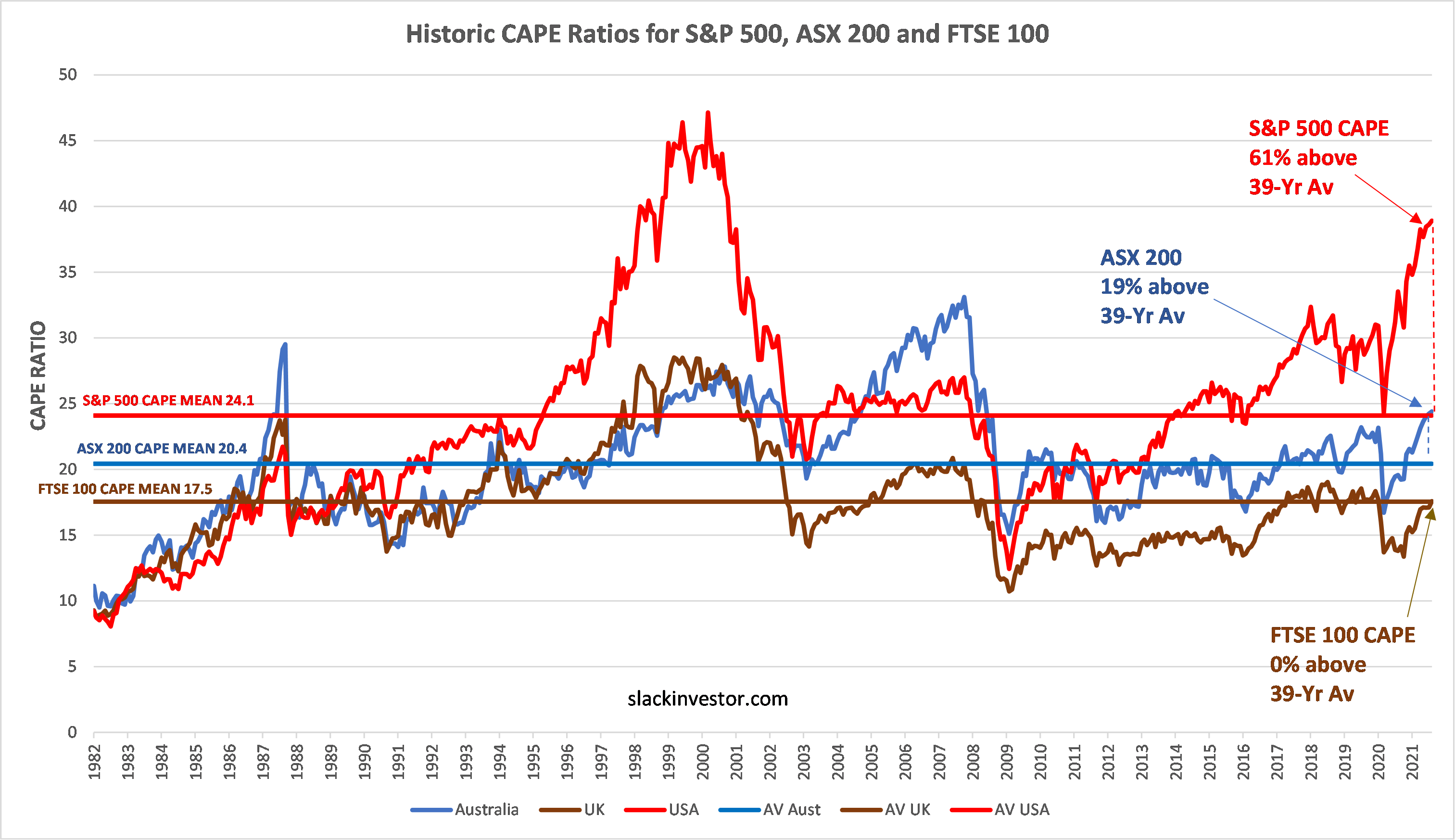

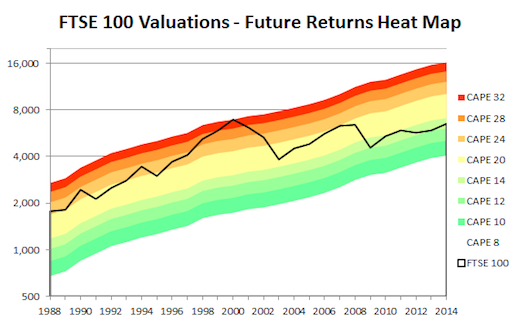

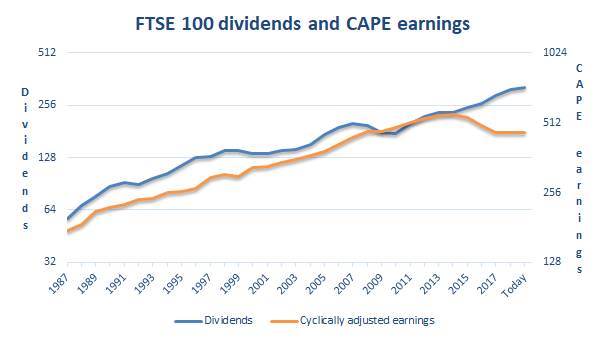

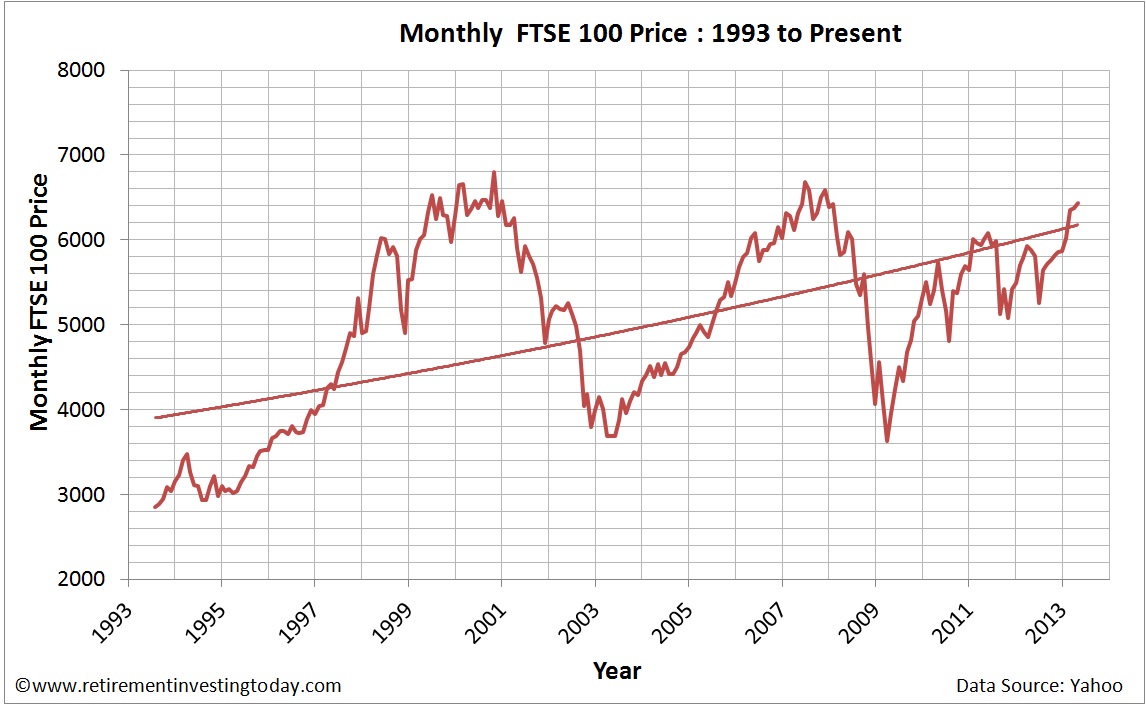

Retirement Investing Today: The New FTSE 100 Cyclically Adjusted Price Earnings Ratio (FTSE 100 CAPE) Update - April 2013

Retirement Investing Today: The New FTSE 100 Cyclically Adjusted Price Earnings Ratio (FTSE 100 CAPE) Update - April 2013

Retirement Investing Today: The FTSE 100 Cyclically Adjusted PE Ratio (FTSE 100 CAPE or PE10) – October 2012 Update

Retirement Investing Today: The FTSE 100 cyclically adjusted PE ratio (FTSE 100 CAPE or PE10) – June 2011