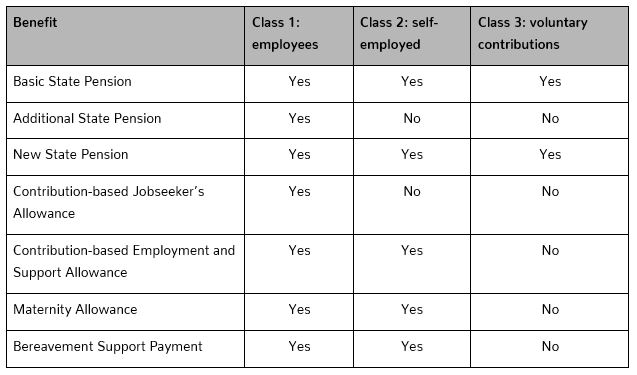

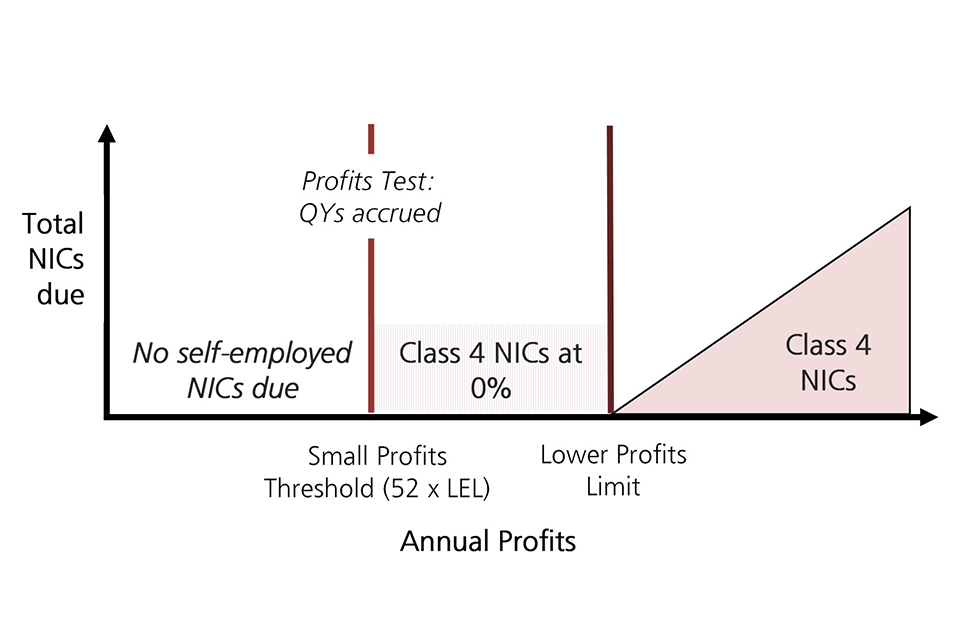

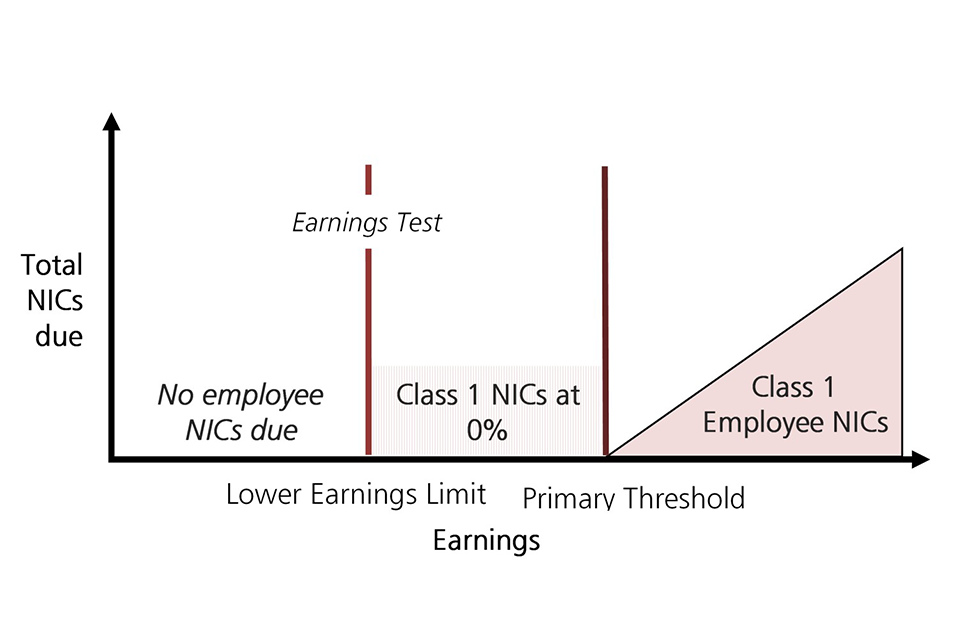

The abolition of Class 2 National Insurance: Introducing a benefit test into Class 4 National Insurance for the self-employed - GOV.UK

Class 2 National Insurance contributions: payments: extended time limits to pay voluntarily - Vinsam Accountants & Tax Advisors

Take action if you filed your 2019/20 tax return after 31 January 2021 and paid voluntary Class 2 National Insurance contributions | Low Incomes Tax Reform Group

Fillable Online CA8480 - Application for repayment of Class 2 NIC - Michael Hoy Fax Email Print - pdfFiller

The abolition of Class 2 National Insurance: Introducing a benefit test into Class 4 National Insurance for the self-employed - GOV.UK